Responding to disasters in hours, not days

When disasters strike, and losses occur, insurance companies understand that there’s nothing more important to their customers than recovering from losses. In these crucial moments, families rely on their insurers to respond as quickly and efficiently as possible. The challenge is identifying, and prioritizing response efforts. Discover an innovative approach to disaster response and claims management that was forged during the costliest storms in recent years. Using Esri technology as a foundation, the National Insurance Crime Bureau (NICB) and Vexcel Imaging teamed up to provide the deploy one of the largest imagery collection applications in recent years.

Make the most of every location

Location influences every decision in insruance risk assessment. From underwriting decisions and that first policy quote, to catastrophe (CAT) response and claims, successful insurance companies leverage location intelligence to go beyond static figures and spreadsheets, and derive actionable insights for decision making. Discover how location intelligence can transoform your enterprise.

EXPLORE A REAL-LIFE SCENARIO

An insurer takes steps to understand risks in the company's portfolio.

Wildfire season has begun, and fires are burning in Northern California. This insurer's first step is to identify what areas are at the highest risk of burning. Mapping how wet or dry locations are based on rainfall indicates places with more fuel for fires. Now the analysts and company managers have an enriched view of places at greatest risk.

EXPLORE A REAL-LIFE SCENARIO

Analysts seek to understand their exposure.

By overlaying data on active policies that are in at-risk-areas, the insurance company can anticipate potential losses and optimize its response based on severity and concentration. The heat map shows policyholder density.

EXPLORE A REAL-LIFE SCENARIO

Next, analysts map locations of highest insured value policies.

As analysts visualize aggregated policyholder data at the district level and areas of high total insured value, they see locations of potential significant losses.

EXPLORE A REAL-LIFE SCENARIO

Winds are changing and exposing more people to devastating fires.

Real-time weather data shows shifting winds. Now this insurer can see how conditions are changing from moment to moment.

EXPLORE A REAL-LIFE SCENARIO

Alerts are sent to at-risk policyholders to improve disaster response.

Combining real-time conditions with policyholder data tells this insurer where customers are at greatest risk. The company sends out alerts with information about how to protect assets and the growing danger in the area.

Case Study

Managing Risk with Location Intelligence

The frequency and intensity of natural disaster has increased in recent years. Explore how insurance industry is addressing these new risks.

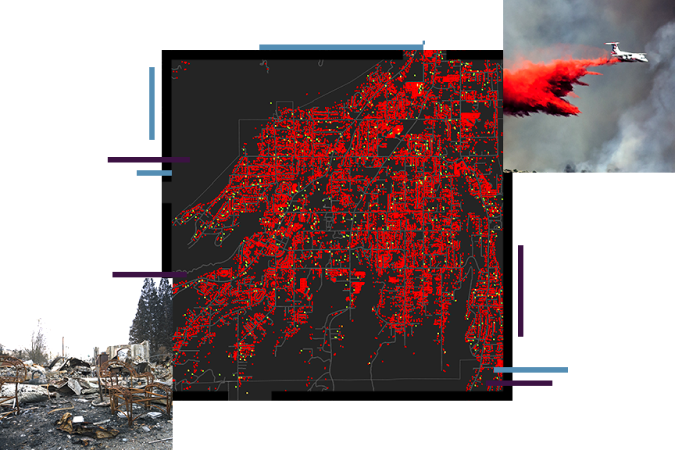

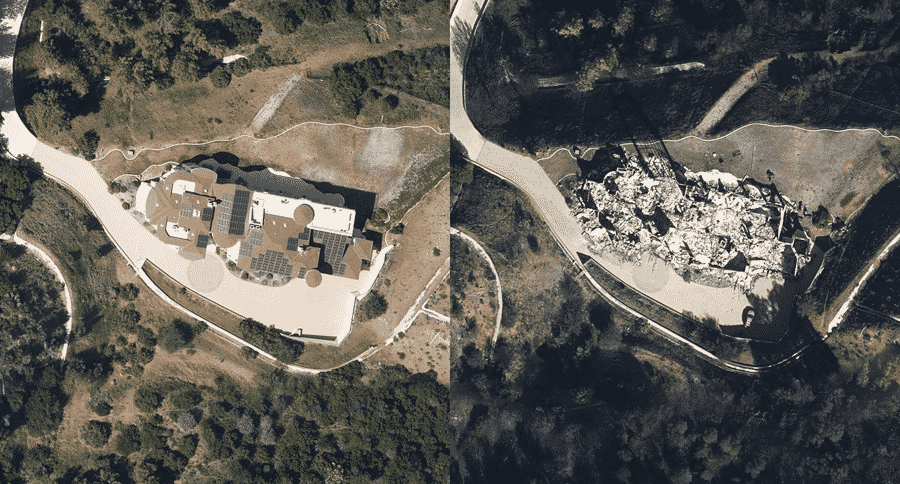

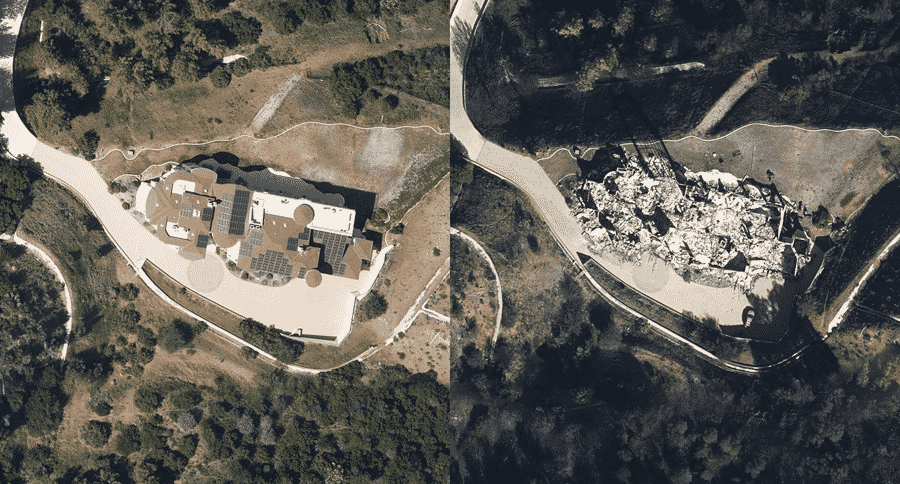

The Unseen: After a Disaster, Imagery Gives Insurance Companies a Clear Picture

New technology on the ground and in the sky is helping insurers see what they haven’t seen before and assist clients more quickly.

Responding to disasters in hours, not days

When disasters strike, and losses occur, insurance companies understand that there’s nothing more important to their customers than recovering from losses. In these crucial moments, families rely on their insurers to respond as quickly and efficiently as possible. The challenge is identifying, and prioritizing response efforts. Discover an innovative approach to disaster response and claims management that was forged during the costliest storms in recent years. Using Esri technology as a foundation, the National Insurance Crime Bureau (NICB) and Vexcel Imaging teamed up to provide the deploy one of the largest imagery collection applications in recent years.

Make the most of every location

Location influences every decision in insruance risk assessment. From underwriting decisions and that first policy quote, to catastrophe (CAT) response and claims, successful insurance companies leverage location intelligence to go beyond static figures and spreadsheets, and derive actionable insights for decision making. Discover how location intelligence can transoform your enterprise.

EXPLORE A REAL-LIFE SCENARIO

An insurer takes steps to understand risks in the company's portfolio.

Wildfire season has begun, and fires are burning in Northern California. This insurer's first step is to identify what areas are at the highest risk of burning. Mapping how wet or dry locations are based on rainfall indicates places with more fuel for fires. Now the analysts and company managers have an enriched view of places at greatest risk.

EXPLORE A REAL-LIFE SCENARIO

Analysts seek to understand their exposure.

By overlaying data on active policies that are in at-risk-areas, the insurance company can anticipate potential losses and optimize its response based on severity and concentration. The heat map shows policyholder density.

EXPLORE A REAL-LIFE SCENARIO

Next, analysts map locations of highest insured value policies.

As analysts visualize aggregated policyholder data at the district level and areas of high total insured value, they see locations of potential significant losses.

EXPLORE A REAL-LIFE SCENARIO

Winds are changing and exposing more people to devastating fires.

Real-time weather data shows shifting winds. Now this insurer can see how conditions are changing from moment to moment.

EXPLORE A REAL-LIFE SCENARIO

Alerts are sent to at-risk policyholders to improve disaster response.

Combining real-time conditions with policyholder data tells this insurer where customers are at greatest risk. The company sends out alerts with information about how to protect assets and the growing danger in the area.

Case Study

Managing Risk with Location Intelligence

The frequency and intensity of natural disaster has increased in recent years. Explore how insurance industry is addressing these new risks.

The Unseen: After a Disaster, Imagery Gives Insurance Companies a Clear Picture

New technology on the ground and in the sky is helping insurers see what they haven’t seen before and assist clients more quickly.