08 Apr Managing Risk with Location Intelligence

Interpreting Big Data Using Location Intelligence

The insurance industry has access to an inordinate amount of data and sources—from data about historic perils and disaster models to current policy information and real-time weather feeds. Oftentimes, the greatest challenge to effective risk management is integrating disparate systems and deriving actionable insights from a large volume of data. Risk analysts need a way to extract relevant information and clearly communicate results with stakeholders. To do this effectively, analysts need more than just raw computational power; they need a way to derive deeper contextual understanding to support critical business decisions. Because of the spatial connection between policies and perils, location intelligence empowers analysts to quickly extrapolate meaningful information and share insights throughout their organizations. Location intelligence promotes contextual understanding by providing an intuitive lens through which complex data can be viewed. Every day, we use location to navigate time and space without considering the magnitude of data that is processed. By applying location data to risk management, analysts, underwriters, and actuaries are able to uncover new market opportunities and identify hidden risks within their portfolio.

How Location Influences Policies and Risk Scoring

Each policy and every peril are tied to location, and understanding this relationship is the first step in mitigating risk. By leveraging location, analysts can integrate data from policy databases, spreadsheets, and third-party vendors to visualize their portfolios. This geographic view of their data provides an intuitive platform for identifying clusters of policies in effect, concentrations of insured value, or metrics on previous claims. With deeper contextual insights into the probable perils within their jurisdictions, analysts are now able to determine the exposure of an individual policy to perils on a hyperlocal level. Location intelligence has transformed actuarial science, leading to advancements in point-based risk scoring. This method of underwriting examines the relative exposure of a policy to the perils it may be subjected to. Point-based risk scoring is a drastic shift from the traditional method of determining rates based on whether a policy was located within a risk zone. Catastrophic damages resulting from flooding during Hurricane Harvey and the Fort McMurray wildfire highlight the need for a better risk scoring method since both events took place outside the traditional risk zones for flooding and fire.

Promoting Shared Situational Awareness

For decades, commercial and governmental organizations have been preoccupied with solutions that create a common operational picture, a comprehensive view that enables each team to extract actionable information. As risk management becomes more complex, this approach will no longer satisfy the needs of the insurance industry. The view needed to track and monitor wildfires, for example, is different for mudslides. Even if these events are not mutually exclusive, the information is distinct, requiring unique analytical workflows and visualizations. To effectively manage these perils, analysts need more than just comprehensive applications; they need shared situational awareness. To achieve situational awareness, the insurance industry needs an integrated platform that leverages common authoritative data sources. This approach empowers analysts who can exploit the same data and share their expertise by producing event-specific information products quickly and without consuming much-needed resources.

To promote shared situational awareness, insurance companies must foster a secure data environment within their organization that enables analysts of various specialties to leverage the skill sets of their colleagues. The insurance industry has traditionally operated under a siloed data model, which prevented teams from collaborating with colleagues from other departments. While there are benefits to aligning teams and resources based on core functions, innovative organizations are beginning to realize the full potential of cross-departmental collaboration.

- Identifying Hidden Risks : In many cases, basic statistics provide a highlevel summary of relevant information but fall short of the actionable insights decision-makers rely on. Your stakeholders not only want to understand what’s going on but also why an event is happening and how it will affect their operations. Esri’s tools for spatial analysis provide analysts with these insights, identifying complex interdependencies between policies and perils to aid strategic planning and decision support.

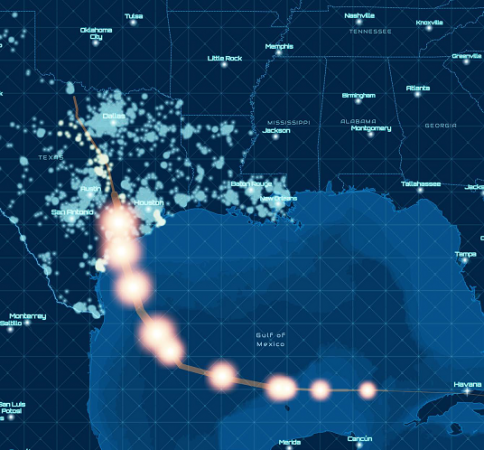

- Impact Forecasting : Analyzing the spatial relationship between policies and risks produces the most accurate representation of the potential impact of an event. Whether you are overlaying a projected storm path portfolio or modeling the potential for flooding in a market you service, understanding and visualizing these relationships provide a clear picture of what’s at stake.

- Catastrophe Planning and Response : When natural events occur and lives are being threatened, time is the greatest adversary of insurance companies. From the time an event is detected through claims adjustment, location intelligence serves a critical role in ensuring that you’re servicing your customer’s needs quickly and effectively.

Communication for Quick Recovery

Knowledge, technology, and expertise are ultimately worthless if they are unable to clearly communicate critical information to decision-makers. In most cases, stakeholders will not have the same level of expertise as analysts, increasing the likelihood of misunderstandings. Location not only serves as an interpretive tool for analysts to understand their data, but it also aids decision-makers by deepening their understanding of strategies. Using the same common data platform, analysts can quickly convert their analyses into digital information products and instantly share them with whomever needs them. From digital maps to interactive reports and dashboards, location intelligence makes it possible to share complex information quickly and clearly. When disasters strike and the situation on the ground continually changes, these digital products are an indispensable resourceto quickly coordinate and respond tothe event and work with policyholders to begin rebuilding their communities.